Monthly Market Insight, January 2025

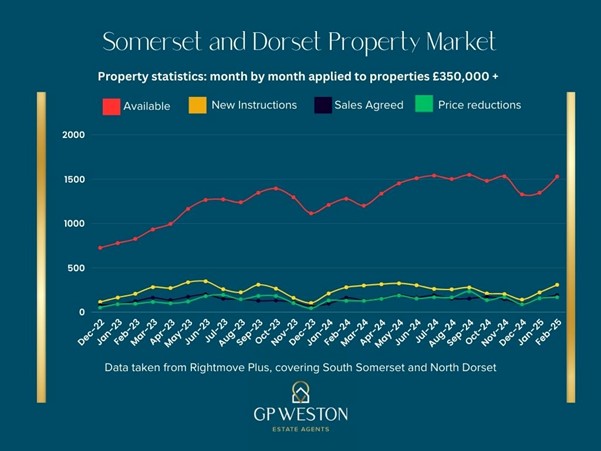

Every month we chart how the number of available properties, the number of new instructions, the number of sales agreed and the number of price reductions in our local area.

We use this data to work out how the numbers could: –

- Affect someone’s decision to put their property on the market.

- Affect how prices could move.

- Determine the length of time it may take to sell.

- Influence whether to price conservatively or ambitiously.

We compare the local market to the national one and use articles from different sources to put meat on the bones.

AVAILABLE PROPERTIES: Due to homeowners wanting both their house and garden to look their best, the country market doesn’t usually take off until March at the earliest, but usually after Easter. However, in February 2025 we saw 308 new instructions compared to just 280 in 2024 and 207 in Feb 2023. As I mentioned last month, this could well be people trying to catch those buyers rushing to beat the stamp duty but in my opinion, they have left it too late.

NEW INSTRUCTIONS: Similarly to the number of available properties, January 2025 saw a higher number of new instructions than the same month in 2024 or 2023. This could be due to sellers trying to catch buyers racing to complete before the stamp duty changes at the end of March. It could also reflect people no longer able to wait out the market and deciding to get on with their lives.

SALES AGREED: The start of the year saw a huge increase in sales agreed with 156 agreed sales in January 2024, compared to just 94 in January 2024 and 92 in January 2023. Like the New Instructions, this is probably due to a combination of wanting to beat the stamp duty deadline and buyers deciding the market has fallen enough and now was time to get on with it.

PRICE REDUCTIONS: Year on year we saw an increase in price reductions in January. Sellers looking to tempt buyers who are wanting to beat the stamp duty deadline and properties over valued in the first place, sitting among an increased competition.

In my last market comment I wrote about how transaction levels coincided with global events. Over the last 20 years we have seen successive governments trying to prop up the housing market with various tax breaks. This has in turn seen the property market go through phases of increased activity followed by lulls in the market as buyers had rushed to meet various deadlines. Thankfully when this government took over, they resisted the urge to meddle in the market and the only thing on the horizon is the stamp duty threshold falling back from £250,000 to £125,000 where it originally was. This will result in a small increase of £2,500 for most buyers. Proportionally, this will have a bigger effect at the lower end of the market than the middle and upper ends.

In conclusion, the market feels stable with plenty of property for buyers to choose from. Buyers are accustomed to the level of interest rates and the consensus is that over time they will come down gradually. This alleviates any worry about decreasing affordability as well as the temptation to wait for a lower rate.

Since the market hit the brakes at the end of 2022, we have had 2 years of falling or static prices. Historically the long-term property cycle is 7-8 years up, followed by 2-3 years down. This means we should be at the bottom of the market and activity and prices should start to pick up and looking at sales agreed for January it suggests this may indeed be happening. As I have said before there is no single “PROPERTY MARKET” rather the market is doing different things in different regions and at different price points. Therefore, when considering whether it is a good time to sell, and what tactics to adopt, it is worth looking at the picture as a whole! For example, if you are thinking of moving to a better performing area, it is worth selling quicker before that market you are buying in to moves further away. Likewise, if you are buying into a region where the market is falling away, then the longer you take to move, the bigger the difference in a positive way.

We pride ourselves delivering sound, honest advice, rather than merely trying to win business by cynically over valuing.

I hope the above has been of interest to you and if you would like to see the source data, discuss how the market might affect your move or when might be the best time sell, I would be delighted to talk to you. I enjoy nothing more than analysing the stats and figures with people. It is all about stats and figures when it comes to property!

Yours James Weston