Monthly Market Insight, November 2024

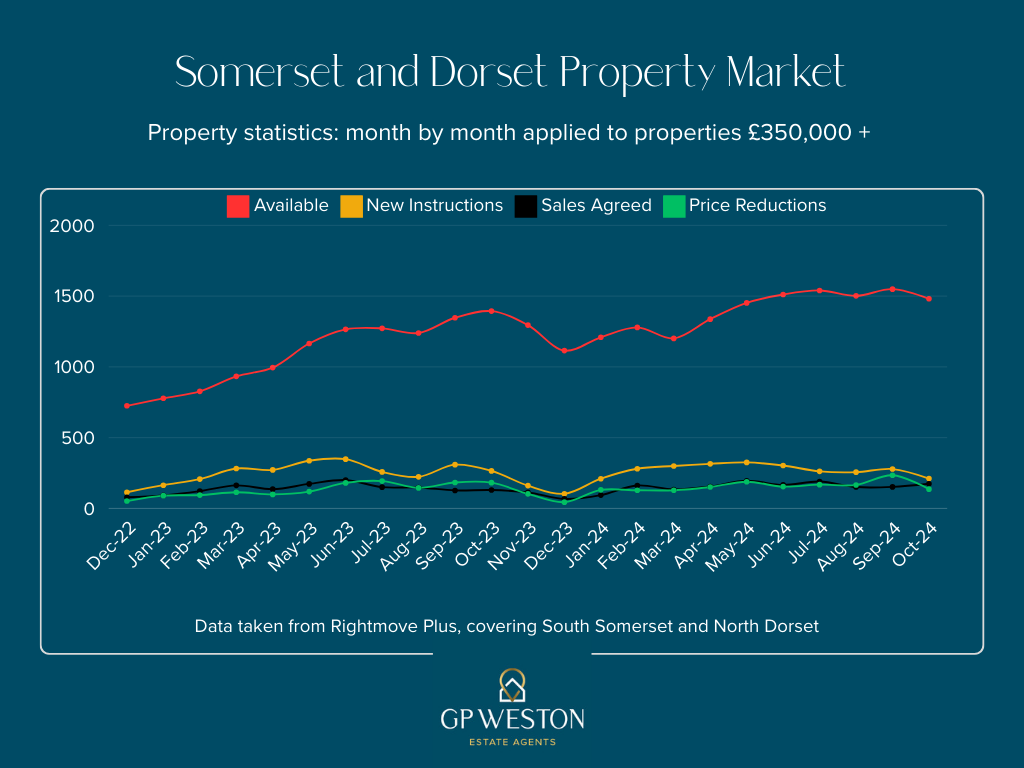

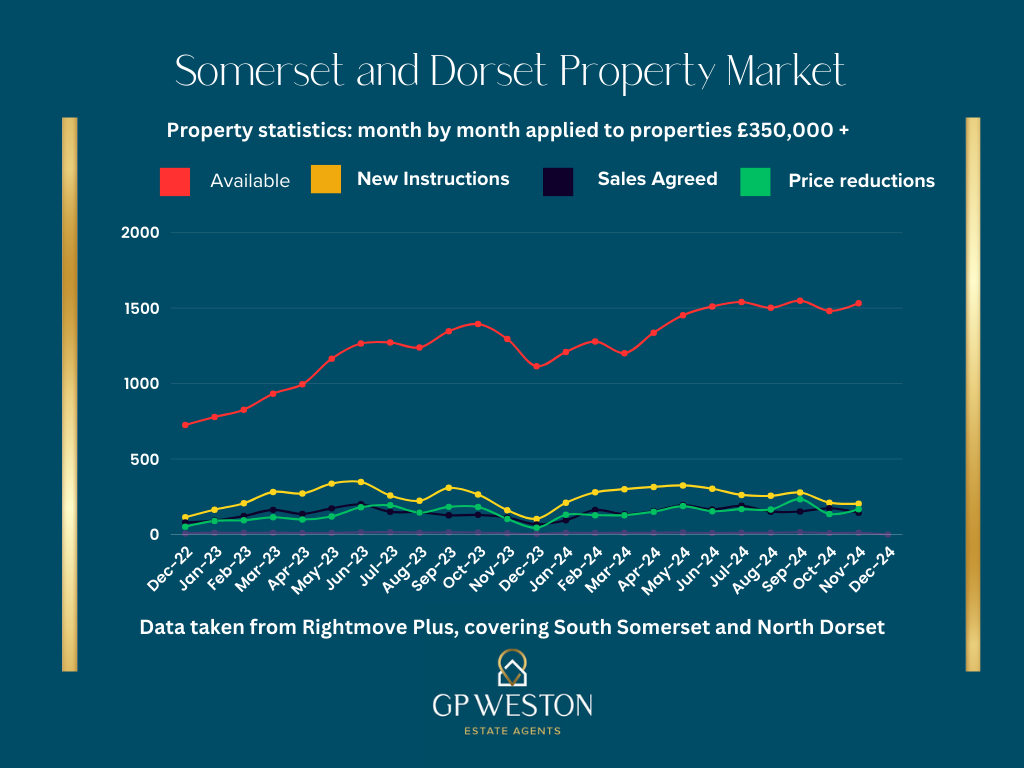

Every month we chart how the number of available properties, the number of new instructions, the number of sales agreed and the number of price reductions in our local area.

We use this data to work our how the numbers could:-

- Affect someone’s decision to put their property on the market.

- Affect how prices could move.

- Determine the length of time it may take to sell.

- Influence whether to price conservatively or ambitiously.

We compare the local market to the national one and use articles from different sources to put meat on the bones.

AVAILABLE PROPERTIES: Last month I commented on how the number of available properties had almost doubled over the last 2 years. By the end of November the number increased by another 50 taking the number of available properties over double (1532 compared to 725). This continues to push prices down gently and also means that properties are remaining on market longer as buyers have more properties to choice from.

NEW INSTRUCTIONS: 2024 has been unusual in the consistency with which properties have been coming to the market. Traditionally the quieter months are Jan, Feb, Jul, Aug, Nov and Dec. as seen in 2023. Whilst we have not seen a ‘summer dip’, there was a decrease in October and this has continued into November. However with stamp duty increasing in April 2025 sellers may be rushing market their properties ahead of the changes, pushing the number of available properties higher than they might otherwise be.

SALES AGREED: Remained fairly consistent with the usual seasonal dips in August and December in 2023, surprisingly in 2024 we didn’t see the dip in August. This could coincide with interest rates beginning to fall, bringing a little optimism back to the market after 2 tough years. We are seeing numbers of transactions drop off as we near the end of the year but perhaps not as much as they might otherwise be due to a rush to beat the increase in stamp duty in April 2025.

PRICE REDUCTIONS: The number of price reductions increased markedly in November as agents push sellers to reduce in the hope of agreeing a sale agreed before the end of the year. Whilst this can sometimes pay off, Sales that do not exchange before Christmas can often “fall through” as buyers change their minds due to having too much time to think. There is a saying “time kills deals”. A good agent drives the conveyancing process to complete before something happens to derail it.

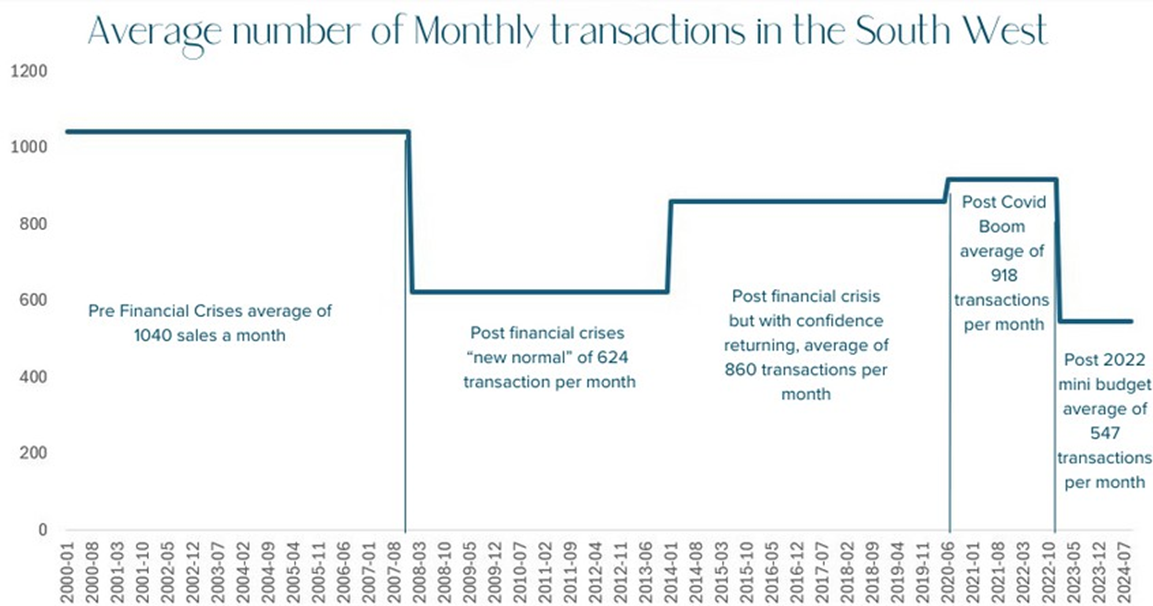

In my last market comment I wrote about how transaction levels had changed over the last 15 or so years. This month I decided to download the Land Registry data for the “South West”. As I looked at the numbers there were some noticeable shifts coinciding with global events. The graph below demonstrates the average number of monthly transactions in the South West and how they were impacted by global events.

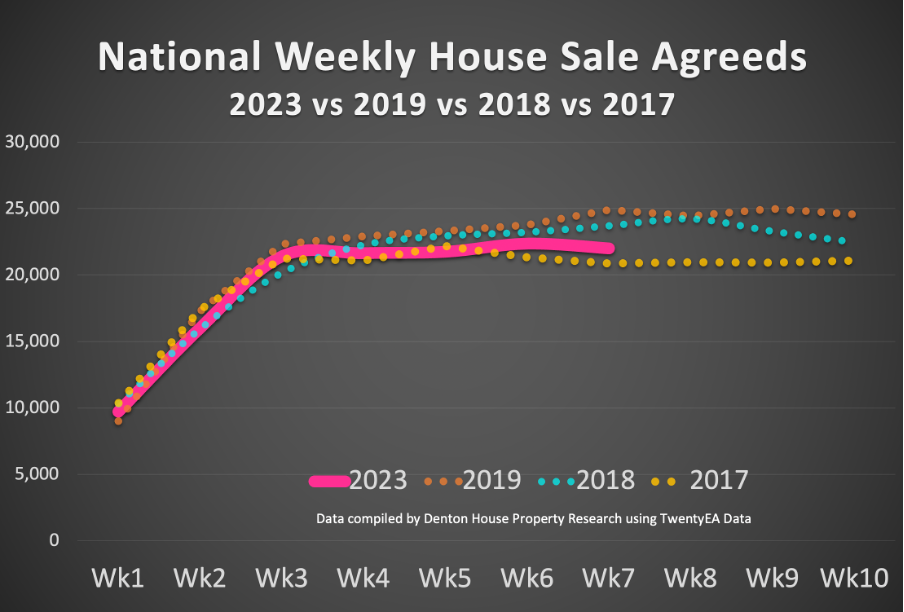

In conclusion, the property market changed significantly and permanently after the financial crisis. Transaction levels dropped by 40% due to caution in lending from the banks and their more stringent stress testing of a borrower’s financial capability. Transaction levels did improve as time went by but was never more than about 80% of the pre-financial crises average.

More recently we had the post-Covid boom where the population re-imagined how they were living and how the home was used. The shift to remote working meant people needed an office, either in the house or in the garden and so there was a significant amount of up-sizing or relocation to cheaper areas.

Now we arrive at the current state of affairs! After the boom of the last two years a lull in activity was inevitable as buyers had brought their move forward. The post 2022 budget sent interest rates up to 5%+ resulting in transaction levels being lower now than even during the post financial crisis. This is evidenced by the number of available properties doubling whilst the sales agreed stays the same.

The era of cheap money is over, certainly for the foreseeable future. Wages are now increasing faster than inflation and house prices have stalled, meaning affordability remains OK for most. However there have been many people in the past couple of years (and an equal number over the next couple of years) who have come off sub 2% mortgage deals and on to 4%, 5% and in some cases even higher mortgage rates. It is testament to the post financial crisis stress testing that there have not been more forced sales but buyers purchasing power has been severely curtailed as monthly payments are significantly higher than they have been for the period between 2008/9 and 2022.

As always there are mixed signals for the market ahead, the members of the Institute of Directors were recently canvassed and their confidence levels for the economy going forward is lower than during the years after the financial crisis. Inflation is currently higher than the target at 2.7% meaning interest rate cuts are likely to be smaller than we had hoped for earlier in the year. The added N.I. costs mean that unemployment might increase a little and wage increases stall.

In 2024 the South West under performed compared to the rest of the country with prices sliding downwards gently compared to the national market with slightly higher average prices. There is a lack of confidence among businesses surveyed by the IOD, the budget has caused inflationary pressures and will likely keep interest rates from being cut as much as they might have been. I think unemployment might rise slightly and wages stagnate a little. But on the positive side, history shows us that people can only put their lives on hold for so long and after 2-3 years the market kicks on again as buyers return to the market having decided they can’t wait any longer.

Many agents have revised their 2025 predictions slightly from a 5% increase to a 4.5% nationally. If the South West performs as it has done in 2024 (i.e. 2.0%-3.0% below the national average) that would see a 1%-2% rise in 2025.

SUMMARY: There are a lot of properties that have been sitting on the market for months and months, some with some significant price reductions of 30% or more and others with no price reductions. In my experience if a property doesn’t sell within 3-4 months it is because it is too expensive in the current market. We don’t see prices increasing more than a percent or two next year and therefore sitting it out is not going to achieve anything and the property will just go stale. If you are currently on the market and not receiving any interest our advice is to couple a price reduction with a switch to a new agent. If you are thinking of coming to the market then consider pricing your property at the lower end of appraisals you receive because that is likely to be the most realistic.

I hope the above has been of interest to you and if you would like to see the source data, discuss how the market might affect your move or when might be the best time sell, I would be delighted to talk to you. I enjoy nothing more than analysing the stats and figures with people. It is all about stats and figures when it comes to property!

Yours James Weston